Society of Motor Manufacturers and Traders (SMMT) chief executive Mike Hawes has said he fears a “New Year nightmare” for UK car manufacturers if the UK Government and EU fail to reach a trade agreement.

Hawes said the threat of ‘no deal’ was palpable, with just nine days to go until the UK’s departure from the union, adding that the sector, now also reeling from the latest coronavirus resurgence, Tier 4 showroom lockdowns and disruption at critical UK ports, needs tariff-free trading “more than ever”.

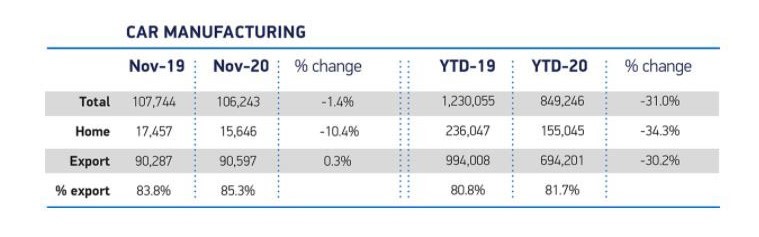

His comments came as the SMMT reported a further 1.4% decline in new car production (to 106,243 vehicles) in UK car plants for November.

Hawes said: “Yet another decline for UK car production is of course concerning, but not nearly as concerning as the New Year nightmare facing the automotive industry if we do not get a Brexit deal that works for the sector.”

Output for the UK’s domestic market declined 10.4% with exports flat, up just 0.3% to 90,597 units, as year-to-date production ended the month 31% down with 380,809 fewer cars manufactured in 2020.

Output for the UK’s domestic market declined 10.4% with exports flat, up just 0.3% to 90,597 units, as year-to-date production ended the month 31% down with 380,809 fewer cars manufactured in 2020.

The relatively small year-on-year decline masks a particularly weak November 2019 when precautionary factory shutdowns in anticipation of a potential ‘no deal’ Brexit on October 31 depressed output.

Spelling out the urgency of the Brexit situation from a UK automotive perspective today (December 23), Hawes stated: “It is finally make or break time, as being forced to trade on WTO terms would be a hammer blow for many automotive businesses, workers and their families, so we must get a deal – and one that avoids the devastation of punitive tariffs for all automotive products, from day one.

“For the long-term survival of UK Automotive, there is quite simply no other option.”

The SMMT has calculated that the production loss of 380,809 vehicles has cost UK automotive some £10.5bn this year.

It has also put the industry on course to produce fewer than a million cars this year for only the second time since the early eighties.

Issues at UK borders are hampering the UK automotive sector even prior to the official Brexit date.

In November Honda paused production at its Swindon car plant due to supply issues caused by a congested border.

Toyota, meanwhile, has decided to bring forward its “planned seasonal stop” at its engine plant in Deeside in north Wales and its factory at Burnaston in Derbyshire, due to supply issues.

The SMMT appeared to concede that the sector is now facing a supply crisis with or without a Brexit trade deal with the EU.

It said: “While any deal at any time before 31 December is better than no deal at all, it is now all but impossible for automotive businesses to be ready and many critical questions remain unanswered.

“Should an agreement be reached, it will need swift ratification by Parliaments, flexible rules of origin thresholds for hybrid vehicles and batteries and a suitable phase in period to allow supply chains to adapt.

“Urgent clarity, in the event of a deal, would also be needed on proof of origin requirements to ensure qualification for tariff-free trade from 1 January, as well as a 12-month grace period on supplier declarations, with reciprocal facilitation measures by our European counterparts.”