An “extremely tough and uncertain economic environment” for car manufacturers has overshadowed a 34% recovery in productivity during August, the SMMT has said.

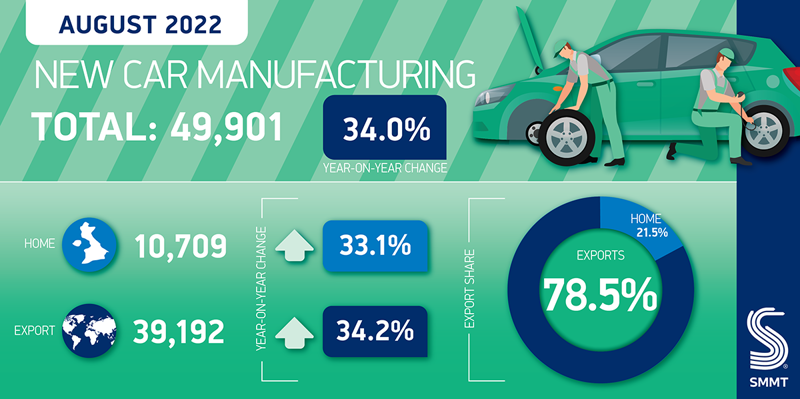

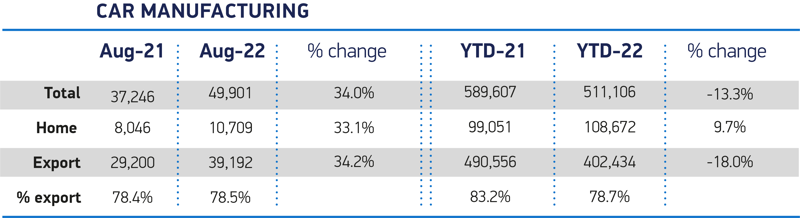

The latest data published by the Society of Motor Manufacturers and Traders (SMMT) showed that UK car production rose 34% to 49,901 units last month.

But the industry body highlighted that the year-on-year growth came 12 months on from a dismal 2021 result, meaning that volumes remained 45.9% down pre-pandemic August 2019.

Year-to-date, however, overall production remains 13.3% down on the first eight months of 2021 at 511,106 units.

Year-to-date, however, overall production remains 13.3% down on the first eight months of 2021 at 511,106 units.

And while the SMMT welcomed the UK Government’s energy price cap, it warned that the limitations of the six-month support plan risked a “spring cliff-edge” for businesses as seven-in-10 firms expressed concern about their future operations.

SMMT chief executive Mike Hawes said: “While another month of rising UK car production is good news, and testament to sectoral efforts to overcome supply chain shortages, it overshadows what is an extremely tough and uncertain environment for manufacturers.

“Volumes are down dramatically, and firms are having to take drastic steps to safeguard their businesses in the face of myriad challenges.

“Volumes are down dramatically, and firms are having to take drastic steps to safeguard their businesses in the face of myriad challenges.

“The government’s measures announced last week to alleviate crippling energy costs provide valuable respite, but long-term action is needed to restore stability and provide the sector with a globally competitive investment framework.

“Reform of business rates, enhanced capital allowances, an affordable and secure supply of low carbon energy, and investment in new skills can enable this critical sector to deliver the economic growth, productivity improvements, balance of trade benefits and job security the UK sorely needs.”

SMMT analysis showed that the UK car manufacturing sector’s combined energy costs – already the highest in Europe – had risen by £100m over the last 12 months to more than £300 million.

Costs expected to more than double again next year, however.

Energy is now the single biggest concern for UK automotive manufacturers, surpassing component supply constraints, with almost seven-in-10 (69%) SMMT members worried about the impact of onerous cost increases on their business operations.

Almost nine-in-10 (87%) OEMs have had to pass on costs, stoking inflation, the SMMT said, with 41% forced to delay or cancel investments, 13% reducing shifts and 9% resorting to cutting jobs.

Voicing the predicament that carmaker’s make in the current economic climate today, KPMG’s head of Automotive in the UK, Richard Peberdy, said: “A gradual easing of global supply shortages, plus government support on energy costs, will aid UK car production in the coming months. But inflation is driving up input costs, and a weakening pound threatens to do so further.

“Passing costs to the consumer is becoming increasingly challenging, although at this stage manufacturers still continue to have busy order books to work their way through.”

Last month’s UK car manufacturing output delivered a 33.1% increase in volume destined for UK customers (10,709 units), while the number of cars built for export rose 34.2% to 39,192.

Last month’s UK car manufacturing output delivered a 33.1% increase in volume destined for UK customers (10,709 units), while the number of cars built for export rose 34.2% to 39,192.

Production of electric vehicles (EV), plug-in hybrid (PHEV) and hybrid (HEV) vehicles also grew, accounting for almost a third (32.2%) of all cars (16,059 units).

EV production more than doubled, rising 115.9% to account for almost one-in-10 cars produced.