In the eight days since May 22 when the FAME-II subsidy was slashed, 57,917 electric two-wheelers were sold in India.

Retail monthly sales of electric two-wheelers have scaled a new high of 1,04,755 units last month, which marks an increase of 57 percent (April 2023: 66,724 units) and translates into 3,379 EVs sold each day in May 2023.

The record retails of 1,04,755 units is as per end-of-day sales statistics on May 31 (as of June 1, 6am), on the government’s VAHAN portal. This number beats the previous best of 85,452 units in March 2023 by a good 19,303 units. It bears mentioning here that sales had fallen by 22 percent month on month in April 2023.

EV buyers rush to buy before June price hike

What has accelerated retail sales in May 2023, more so in the last week of the month, is the government’s decision on May 22 to revise the FAME-II subsidy to Rs 10,000 per kWh, compared to Rs 15,000 per kWh. Furthermore, the cap for incentive has been brought down to 15 percent of the vehicle’s ex-factory price compared to the 40 percent benefit extended earlier.

This was reason enough for value-conscious vehicle buyers of electric vehicles to advance their purchases before EV manufacturers raised prices. The rush of new purchases can be gleaned from the fact that between May 23 (when retail sales were registered at 46,838 units) and May 31, a total of 57,917 electric two-wheelers were sold. That’s 7,239 units sold in the last eight days, nearly a thousand units in each day.

Ola, TVS, Ather and Bajaj clock best-ever monthly sales

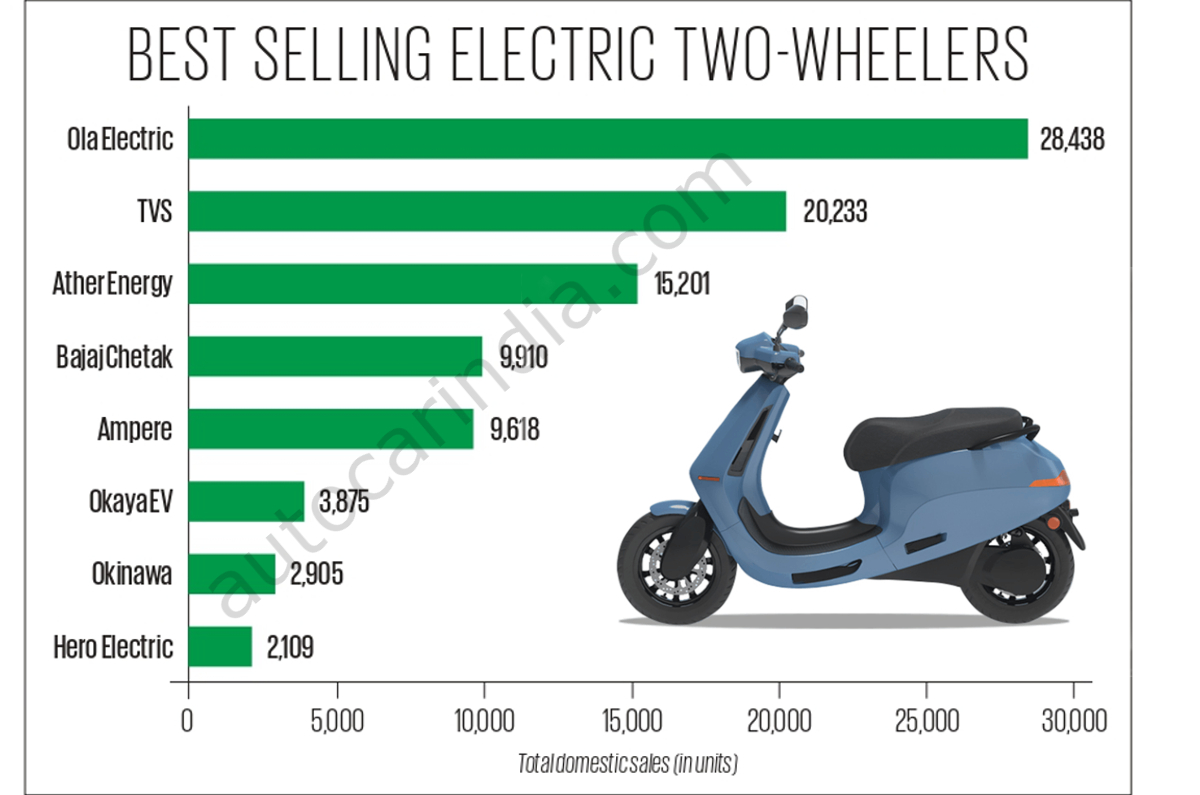

While the top three OEMs – Ola Electric, TVS Motor Co and Ather Energy – saw demand for their products rise sharply, Bajaj Auto rose up the ladder to take fourth rank for the first time with a 168 percent month-on-month increase in sales to 9,910 units. All these four EV makers also recorded their best-ever monthly sales yet.

Market leader Ola Electric recorded retail sales of 28,438 units comprising the S1 Pro and S1 e-scooters, beating its previous best of 21,991 units in April 2023 by 29 percent. TVS Motor Co’s iQube also crossed the 20,000-unit mark with 20,253 units, surpassing its previous best of 17,878 units in March 2023 and recording 131 percent month-on-month growth over April’s 8,751 units. Third-placed Ather Energy also hit a new monthly high in May 2023 with 15,256 units, growing 96 percent over April’s 7,786 units. Meanwhile, Ampere Vehicles took fifth place with 9,618 units, up 15 percent over April’s 8,324 units.

The combined sales of these five OEMs add up to 83,475 units of the total 1,04,755 EVs sold in May, which translates into 80 percent of total sales last month.

Okaya EV, which has never recorded sales of more than 2,000 units since the start of this calendar year, has for the first time been among the leading EV OEMs, with sales of 3,875 units.

Growth outlook

With the reduced FAME II subsidy kicking in from June 1, which will drive prices of e-scooters and e-motorcycles upwards by a minimum of an estimated 10 to 15 percent, demand should slow down in the next few months before possibly picking up during the festive season later in the year.

Nevertheless, despite the higher prices as a result of the reduced FAME-II subsidy, the growth prospects for the domestic electric two-wheeler industry remain strong, particularly in the face of high petrol and diesel prices compared to the wallet-friendly impact of eco-friendly travel on two wheels.

While a few OEMs have already revised their prices, expect the bulk of manufacturers to do so in the coming days. Watch this space for regular price change updates.