Manufacturer support for on-site EV charging infrastructure is emerging as one of the principal areas of concern for dealers.

According to the latest NFDA Dealer Attitude Survey (DAS) which was carried out over five weeks between the end of January and the start of March 2024 and which secured 2,321 responses from 32 franchised networks the topic of on-site EV charging infrastructure featured as the lowest scoring in the survey and highlights that there is a lot of concern amongst dealers regarding manufacturer support here.

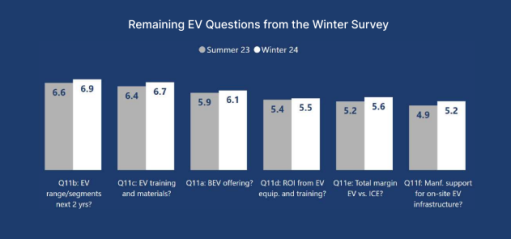

While the question saw a score increase of 0.3 to 5.2 from 4.9 in the Summer 2023 edition, a 6.1% change, it also saw several manufacturers drop down several places from the previous edition, with Audi, Skoda, Suzuki, Cupra, and Volkswagen all dropping at least 11 places, highlighting that there is much concern among dealers.

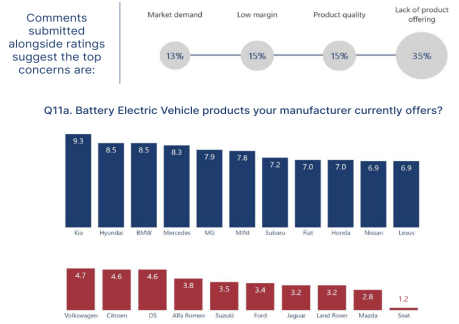

Dealer satisfaction levels for battery electric vehicles currently offered by manufacturers received a 0.2 increase to 6.1 from 5.9 in the Summer 2023 edition of the survey, equating to a 3.4% change.

The highest three manufacturers rated for this question saw Kia top with a score of 9.3 and both Hyundai and BMW rounding off the top three with a joint score of 8.5. The lowest scores were received by Seat (1.2) and Mazda (2.8), whilst Jaguar and Land Rover both received a score of 3.2.

Comments submitted by dealers alongside ratings suggested concerns from dealers included the lack of product offering (35%) and product quality (15%).

In terms of return on investment in equipment/training for EV and plug-in vehicles, Kia maintained the top position for this question, receiving a score of 8.5, equal to their score in the previous edition.

MINI moved up to second place receiving a score of 7.7, whilst Nissan surged up the table with a score of 6.9 to move from ninth in the previous edition to fourth in this survey. MG slid down the table from second in the previous edition to sixth with a score of 6.7 whilst Seat (2.3), Volkswagen (3.4) and Jaguar (3.8) received the lowest scores.

This topic received an average score of 5.5, a 0.1 increase from the previous survey which demonstrates that concerns remain amongst dealers surrounding electric vehicle/plug-in vehicle ROI and training.

In terms of total margin on new EV/hybrid sales compared with new ICE sales, the question received an average score of 5.6 in this survey, an increase of 0.4 from the last edition and a change of 7.7%.

Kia again took the first spot with a score of 8.0, whilst previous leaders MG dropped down to sixth position with a score of 6.6. Mercedes-Benz moved up to second place with a score of 7.9 whilst MINI completed the top three with 7.6.

Abarth made considerable ground, moving from 21st position to eighth with a score of 6.2, as did Vauxhall, moving from 28th position to 15th with a score of 5.9. Conversely, Hyundai dropped down the table from eighth to 18th with a score of 5.3, as did Mazda from 11th to 27th with a score of 4.2.

The final topic on manufacturer’s electric vehicle charging information and training, was a new addition to the DAS and sought to find out from dealers whether training/information on electric vehicle charging provided by their respective manufacturers adequately prepares customers for a successful transition to EVs.

This question received an average score of 6.2, producing a mixed response from the dealer network. Kia once again received the highest score, with 8.7, whilst BMW and MINI came second and third with 8.3 and 8.1, respectively. Seat received the lowest score for this topic with 1.8, far behind Suzuki who received the second-lowest score of 4.0.

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial retailers across the UK, commenting on the results of the NFDA Dealer Attitude Survey said: “It is positive to see each EV topic featured in the DAS see a general uptick in average scores. Yet, once again, EV topics were among the lowest scoring questions with dealers concerned, regarding various factors including manufacturer support for infrastructure.

“From an EV perspective, the DAS shows that there are certainly areas where manufacturers can improve their relationship with dealers such as with support and investment.

“Many dealers have also noted their frustrations with the Government and that more needs to be done in terms of charging infrastructure and cost.

“The ZEV mandate, introduced earlier this year, requires OEMs to meet a target this year of 22% of new car sales and 10% of new van sales to be zero emissions or face penalties. This target percentage will gradually rise each year reaching 52% of new cars and 46% of new vans by 2028.

“As such, manufacturers must heed the concerns of their respective dealerships as illustrated in the DAS. A closer manufacturer-dealer relationship particularly regarding electric vehicle training and support will in turn be extremely beneficial for consumers during the UK’s transition to electric.

“NFDA’s Electric Vehicle Approved (EVA) accreditation scheme has been vital during this transition. EVA was developed in 2019 to recognise retailers’ excellence in the electric vehicle sector and last year surpassed the milestone of 500 accredited sites.”