Just over half of UK motor retailers believe they’re ready for the changes to motor finance rules which are being brought in on January 28.

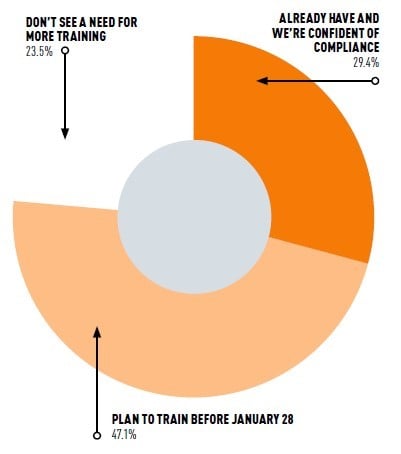

Almost a quarter of respondents to our latest poll, which asked whether they were training staff on commission disclosure ahead of the January changes implemented by the Financial Conduct Authority, think there’s no extra need for staff training, while slightly more say they’ve already brought their workforce up to speed.

But when our poll ran between November and December almost one-in-two dealers were still planning to bring in more training before the new rules come info force.

But when our poll ran between November and December almost one-in-two dealers were still planning to bring in more training before the new rules come info force.

Following the Financial Conduct Authority (FCA) 2018/19 motor finance review, it has stipulated that from January 28 dealers and brokers must prominently disclose that they earn commission from arranging motor finance where knowledge of that commission could have a material impact on the car buyer’s decision to sign.

Keen to ensure consumers are treated fairly, the FCA has also banned certain commission models which previously allowed dealers and brokers to ramp up their rates and earnings.

in December research by Close Brothers Motor Finance found that although 69% of motor retailers have heard about the changes only 33% of those have actually read the FCA’s details explaining them.

Seán Kemple, Close Brothers Motor Finance managing director, said: “Dealers need to understand the rules and be well prepared to make changes where needed, as soon as possible.

The potential risks to car dealers and motor finance houses are huge – in December the FCA fined banking giant Barclays £26 million for failures in relation to its treatment of consumer credit customers who experienced financial difficulties.

The FCA’s principles-based regulation puts the onus on registered lenders and credit brokers, such as car dealers, to ensure customers get fair treatment and positive outcomes.