Jato Dynamics data across 28 European markets reveals that the SUV market share has possibly reached a peak.

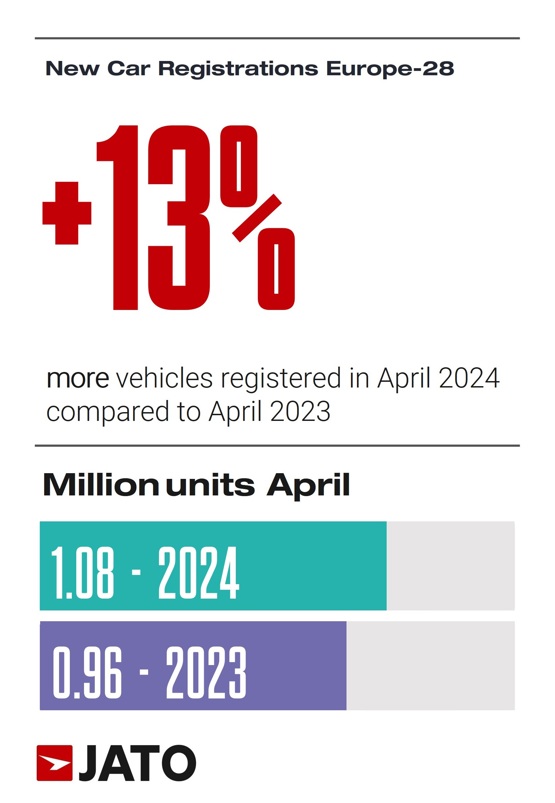

April was largely positive for Europe’s new car market with a total of 1,080,517 vehicles registered during the month, marking a 12.6% increase compared to April 2023.

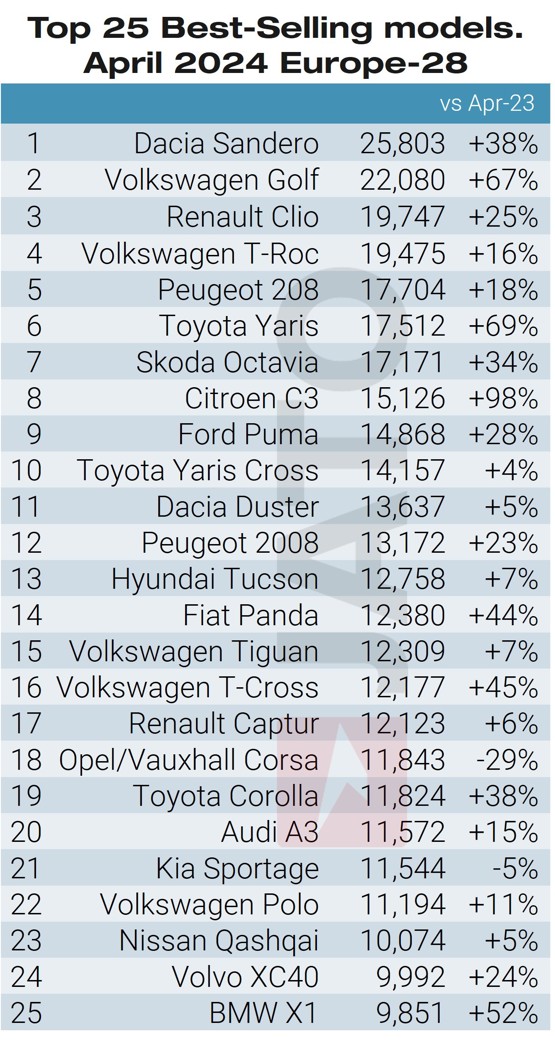

This growth was primarily driven by demand for B-hatchbacks and compact cars. Year-to-date figures indicate 4,461,734 new units registered so far in 2024, a rise of 6.7% over the same period last year.

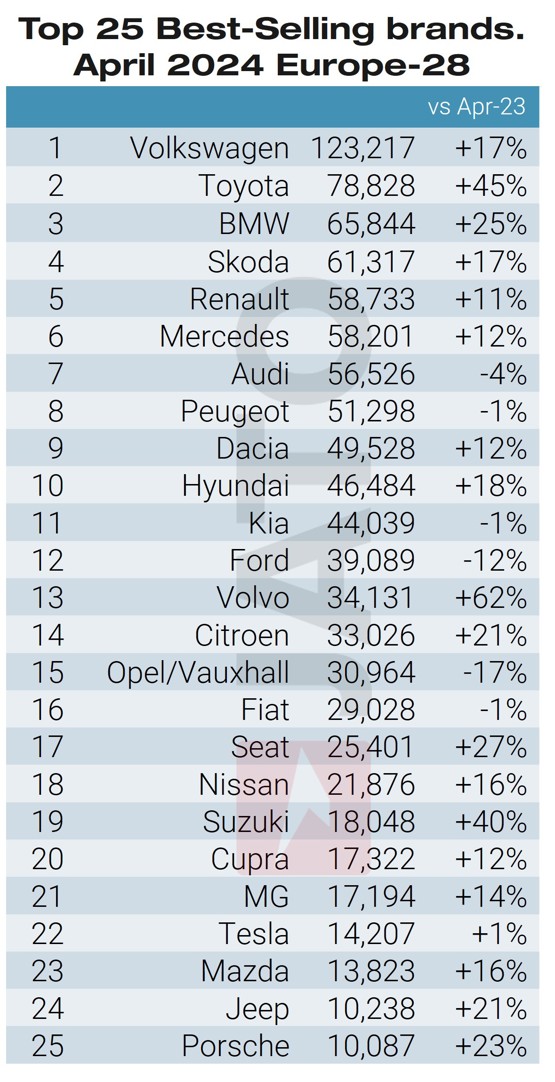

Despite their historical popularity, the market share of SUVs dropped from 51.3% in April 2023 to 51.1% in April 2024. SUV registrations increased by only 12% year-on-year, lagging behind the overall market growth.

Within the SUV segment, brands like Audi, Ford, Kia, Renault, and Skoda faced struggles in April, while BMW, Hyundai, Mercedes, Toyota, Volkswagen, and Volvo gained market share.

Similarly, despite the recent dominance of EVs, SUVs, and Chinese-made cars, JATO’s latest monthly data indicates a shift.

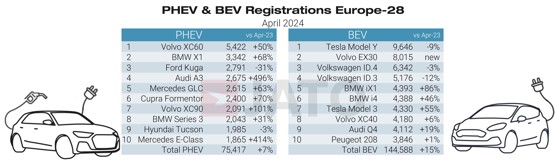

In April, the market share of battery electric vehicles (BEVs) increased by a modest 0.3 percentage points, from 13.1% in April 2023 to 13.4%. Monthly registrations for BEVs rose by 15%, a figure higher than the overall market growth but significantly lower than the increases recorded last year.

Felipe Munoz, global analyst at Jato Dynamics, said the fact that the electric car market is not performing as well as it was this time last year. was largely due to ongoing price cuts.

“These have raised concerns among consumers over the residual value of EVs and uncertainty as to how prices will evolve in the coming months.”

Volkswagen continued to dominate the BEV market in April, despite a 7% decline in volumes compared to last year. Tesla saw a slight 0.6% growth in registrations, with the Model Y maintaining its position as the top BEV model.

However, BMW was the standout performer in April, with registrations of its electric models soaring 82% year-on-year, registering 14,179 units—just 28 units fewer than Tesla. Volvo also had a strong month with 13,275 units registered, marking a 141% increase from April 2023, driven by the popularity of the Volvo EX30, Europe’s second best-selling BEV in April.

BYD registered 2,746 units, surpassing Cupra, Nissan, and Toyota to become the 15th best-selling brand in the BEV rankings. Conversely, brands like Opel/Vauxhall (-37%), Polestar (-26%), Skoda (-13%), and MG (-12%) saw declines in their electric model registrations.

Despite BYD’s success, Chinese-made cars have yet to become a significant force in Europe. The market share of Chinese car brands in Europe rose slightly from 2.22% in April 2023 to 2.35% in April 2024. MG accounted for 68% of the 25,360 total units registered by Chinese brands during the month.

Munoz noted, “Although there is a lot of noise around the arrival of Chinese car brands in Europe, they are still something of a rarity – evidenced by the slow uptick in registrations over the past year. MG, a brand that many still associate with the West, accounted for two in three registrations of Chinese-made vehicles.”

Munoz added that the continued struggle of Chinese-made vehicles to penetrate Europe’s automotive market could be due to perception issues and negative impact from the European Commission’s investigation. Even so, Chinese-made cars continue to prosper in the BEV market, holding a 6.6% market share.