Significant challenges remain for the automotive industry, notably in the form of ongoing supply shortages and the spread of Omicron

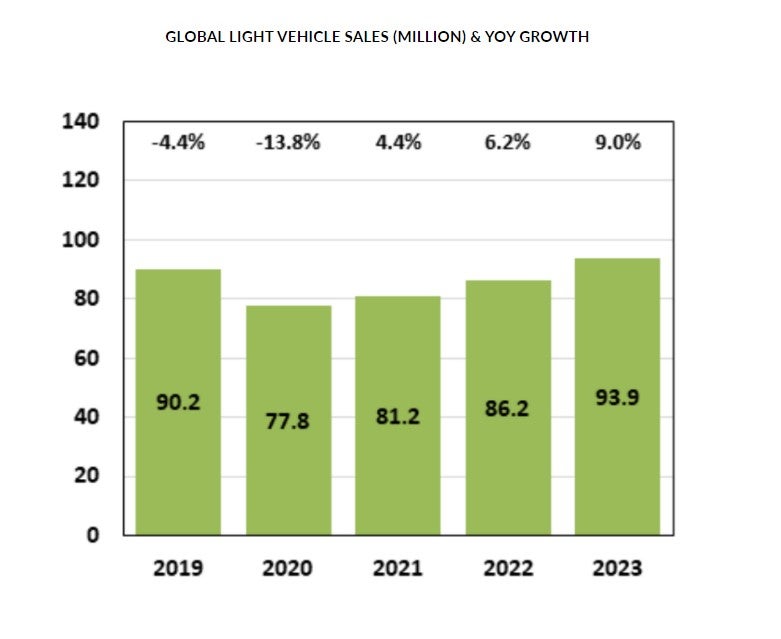

In the final few months of 2021, the global Light Vehicle (LV) selling rate crept back above 80 million units/year, from the year’s low point of 74 million units/year in September. The latest months’ data suggest two things. First, the worst of the sales hit from the supply disruption may have already taken place. Second, market activity remained well below pre-pandemic norms of 90+ million units/year.

As it stands, market volumes are falling well short of underlying demand — inventory remains tight while discounts are lower and transaction prices are higher. Omicron only adds to a complicated picture, with this latest variant of coronavirus proving more transmissible, though as it appears to be leading to a smaller increase in hospitalisations, the disruption is expected to be more muted than with previous virus iterations. That is not to say there is no impact, whether via government measures, increased voluntary social distancing, or absenteeism from work, but the risk of a major economic downturn is more modest. The current base forecast from our partners at Oxford Economics assumes 4%+ global GDP growth for 2022, even if caution around the Q1 performance has increased. That growth will be supported by recovering household spending, itself benefitting from the partial release of accumulated savings built up during the pandemic, even though household budgets are facing generally higher inflation.

Yet, despite a supportive backdrop for underlying demand, the shadow cast by the supply shortages, most notably relating to that of semiconductors, will continue to act as a drag through 2022 — Toyota’s recent announcement that it would miss its annual production target because of parts shortages and the pandemic only reinforces that view. And even if the Omicron variant does not knock demand off course, it still poses a further threat to the global supply chain.

With the above in mind, our baseline view for global LV sales remains one of generally improving selling rates through the year, as supply constraints ease and vehicle plant output picks up, though annual volume will continue to lag pre-pandemic levels until 2023.

Jonathon Poskitt