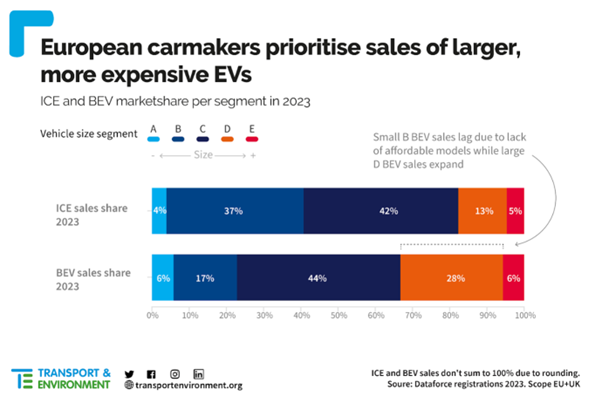

Only 17% of electric cars sold in Europe fall into the affordable compact B segment, compared to 37% of new combustion engine vehicles, according to new analysis from Transport and Environment (T&E).

This disparity suggests that carmakers are hindering electric vehicle (EV) adoption by prioritising the sale of larger, more expensive electric models.

Between 2018 and 2023, the report reveals that only 40 fully electric models were introduced in the compact segments (A and B), while 66 large and luxury models (D and E) were launched.

In Europe, 28% of electric car sales are in the large car D segment, far higher than the 13% of new combustion car sales, as per T&E’s analysis of 2023 sales figures from Dataforce.

Additionally, T&E notes a significant increase in the average price of battery electric cars in Europe by 39% (£15,000) since 2015, contrasting with a 53% decline in China.

Anna Krajinska, T&E’s vehicle emissions manager, is critical of European carmakers for not introducing affordable EV models quickly and at scale, which she believes is limiting mass-market adoption.

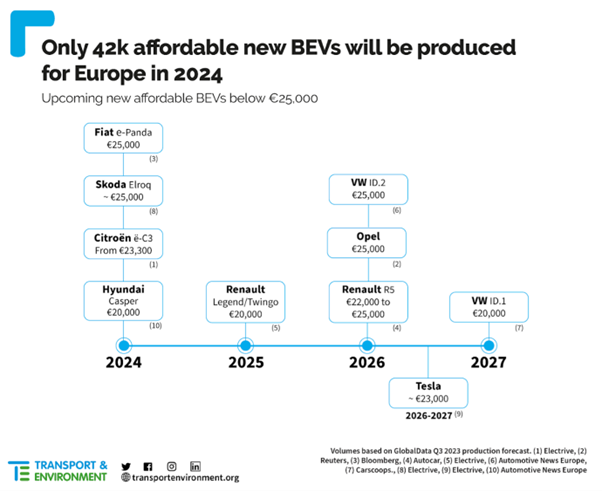

T&E claims that of the sub-€25,000 (£21k) models planned by carmakers, only 42,000 vehicles are expected to be produced for the European market in the current year.

This contrasts with China, where 75 BEV models are available for less than €20,000. Krajinska highlighted the disparity in pricing, with average prices in Europe remaining high even in the compact segments: €34,000 (A), €37,200 (B), and €48,200 (C).

Moreover, the focus of European carmakers on SUVs, accounting for 54% of BEV models launched since 2018, has further impacted affordability as SUVs command a significant price premium compared to non-SUV models in the compact B (+€6,100) and C (+€12,100) segments.

While some European carmakers have announced plans to introduce cheaper compact models between 2024 and 2027, such as the Renault 5 and VW ID.2, the projected production volume for 2024 in Europe is less than 50,000 units, unlikely to meet demand and could leave the European compact mass market vulnerable to Chinese competition.

Krajinska warned that many Chinese brands are entering or planning to enter the European market with electric models, often at more affordable prices and potentially aggressive strategies of Chinese competitors.

“Chinese carmakers may potentially even sell some models at a loss to gain brand recognition and market share. Even if regulations stagnate, incentives are rolled back and the economic climate is not ideal, European carmakers are mistaken if they believe slowing down now will help their competitiveness or survival.”