The commercial vehicle sector has suffered its eight month of decline, as August’s registration figures were 24.6% down.

A total of 15,520 units were sold, during what is traditionally one of the quietest months of the year ahead of the September plate change, according to the Society of Motor Manufacturers and Traders (SMMT).

In contrast, the passenger car figures for August showed signs of recovery for the UK’s automotive sector with a 1.2% rise in registrations.

The scale of the decline in the LCV marker is artificially inflated in comparison with last year, according to the SMMT, which said August 2021 was the second-best performance on record since the introduction of the two-plate system.

For 2022, however, global supply chain challenges have acted as a “handbrake” on registrations, albeit the impact has been unevenly distributed across vehicle segments. The SMMT said growing economic headwinds are also a concern.

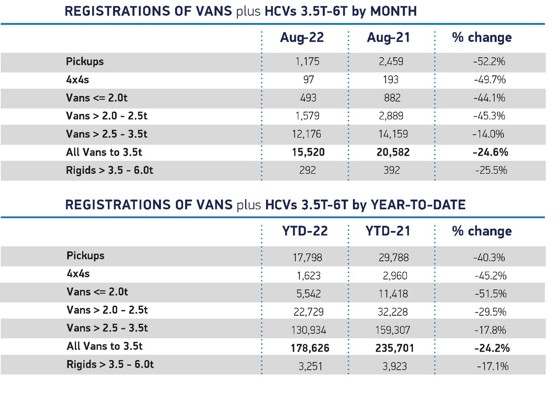

Every LCV class recorded a decline. The biggest decline was recorded in pick-ups, which saw registrations fall by 52.2%.

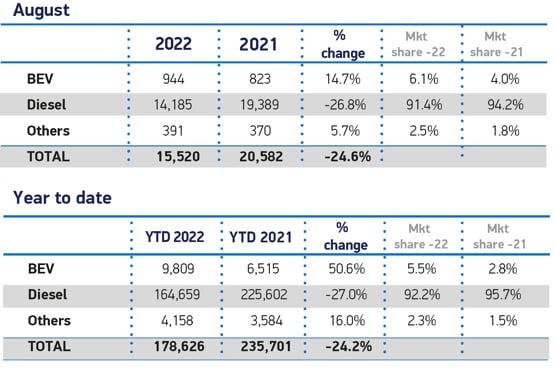

Battery electric vehicle (BEV) registrations rose by 14.7% to reach a 6.1% market share (from 4.0% a year ago) as more buyers take advantage of purchase incentives, lower taxation, exemptions from congestion and clean air zone charges in urban areas.

Battery electric vehicle (BEV) registrations rose by 14.7% to reach a 6.1% market share (from 4.0% a year ago) as more buyers take advantage of purchase incentives, lower taxation, exemptions from congestion and clean air zone charges in urban areas.

As operators choose to delay the acquisition of new vehicles until the ‘new plate month’ in September, next month will be crucial for the industry struggling to repeat the success it saw in 2021. Year to date, LCV registrations are down by 24.2% on 2021 and 27.2% down on pre-pandemic 2019.

Mike Hawes, SMMT chief executive, said, “Last year’s bumper LCV market meant it was always going to be challenging to repeat that success in 2022, and increasingly strong economic headwinds and supply chain challenges continue to test the market. Good progress is being made in the transition to electric, but accelerating the switch will need action from the new Prime Minister to tackle energy costs and inflation, while also encouraging greater charging infrastructure rollout, so that businesses can have greater confidence to upgrade their van fleets to cleanest, greenest models.”

Used van values continue to climb, meanwhile, with average prices passing the £10,000 mark for the first time in July, according to BCA.