The under-pricing of used car stock cost UK car dealers £25.5 million in missed retail opportunity in March alone as average values continued to rise, Auto Trader data shows.

The online automotive marketplace revealed that the average forecourt missed out on £3,300 in potential margins last month as the price average used car advertised on its website rose by 2% year-on-year and 0.2% month-on-month to £17,712.

Auto Trader’s data showed that nearly 7,700 of its circa 15,000 retailer partners advertised their cars below their current market value.

Whilst used car prices have grown YoY for 36 consecutive months, the rate of growth has eased since an April 2022 peak of 32.2%. March marked a reversal of this trend, however, rising from the 1.3% recorded in February.

The value growth was the largest on record for Auto Trader during March, sitting well ahead of pre-pandemic norms, where prices typically declined by 0.4%.

Auto Trader’s director of data and insight Richard Walker said: “Against a backdrop of political and economic uncertainty, used car prices, and the market more broadly, has gone from strength-to-strength in Q1. It’s a very encouraging start to the year and these strong market indicators adds to our confident outlook for the months ahead.

“Whilst other parts of the economy are subdued, the car industry is once again proving its resilience, but many retailers are inadvertently leaving profit potential on the table. To ensure businesses are securing the strongest margins possible, it’s vital they follow the data.”

In a recent mid-month catch-up with AM, Cap HPI director of valuations Derren Martin flagged up the issue of car retailers’ aversion to raising used car values against the backdrop of the cost-of-living crsis.

But Auto Trader’s valuations data conflicted with Cap HPI’s appraisal of the sector, with its three-year and 60,000-miles values benchmark declining 0.5% at the end of a trading period which had otherwise “surpassed all expectations” for many car dealers.

National Franchised Dealers Association (NFDA) chief executive Sue Robinson said: “It’s incredibly encouraging to see an acceleration in price growth and consumer engagement on Auto Trader. With the average retail value of used cars up 2% year-on-year, on a like-for-like basis, coupled with robust consumer appetite, dealers are confident that the strong levels of trading exhibited in the opening months of this year, will continue into Q2.”

National Franchised Dealers Association (NFDA) chief executive Sue Robinson said: “It’s incredibly encouraging to see an acceleration in price growth and consumer engagement on Auto Trader. With the average retail value of used cars up 2% year-on-year, on a like-for-like basis, coupled with robust consumer appetite, dealers are confident that the strong levels of trading exhibited in the opening months of this year, will continue into Q2.”

Auto Trader’s suggestion that consumer demand remained buoyant in Q1 follows the publication of Society of Motor Manufacturers and Traders (SMMT) data which showed new car registrations had grown 18.2% in March and 18.4% in the three-month period as a whole.

Despite the traditionally buoyant month for used car stock, Auto Trader said that used car values had been buoyed by an 11% YoY dip in supply during March.

At the same time Auto Trader said that it had attracted nearly 238 million cross platform visits to its marketplace in Q1, with March’s 82.5 million visits up by 13.2m on the same month last year.

It claimed that this had translated into 9% used car sales growth last month and a YoY acceleration in days to sell from 28 to 26 days.

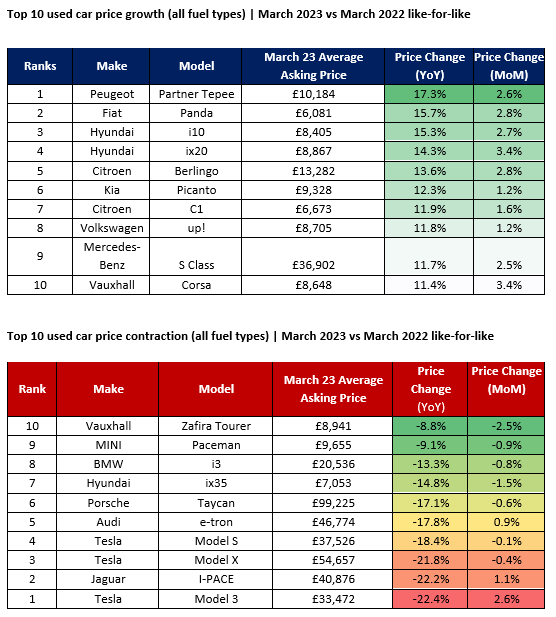

Below, Auto Trader details its best and worst performing cars by YoY value movement in March 2023: