March saw heartening signs of retail prices of used cars continuing to stabilise as movements adopted more usual seasonal patterns.

According to the Auto Trader Retail Price Index, which is based on 800,000 daily pricing observations, and the data for which has now been fully incorporated into the Office for National Statistics’ inflationary measures, average prices softened just -0.7% month-on-month (MoM) in March, which is consistent with pre-COVID norms for this time of year.

It said the used car market entered the second quarter with significant momentum, with both speed of sale and levels of consumer engagement on its marketplace platform, reaching record levels in March.

As such retail prices are stabilising largely due to favourable market dynamics. Auto Trader’s onsite data shows that overall consumer demand rose 6% YoY last month, outpacing current levels of supply growth, which were up just 0.7% – the lowest level of supply growth since July 2023.

The robust levels of demand in the market is reflected in the record 89.1 million cross platform visits to Auto Trader in March. It marks an 8% year-on-year (YoY) increase, and a 9% rise on February’s otherwise very strong performance (81.7m). Across the quarter, Auto Trader received over 256.4m visits to its marketplace, up 18.7m on Q1 2023.

Used cars also took an average of just 25 days to leave retailers’ forecourts last month, which was two days faster than February and three days faster than March last year. It also marks the fastest monthly pace ever recorded by Auto Trader.

Importantly, it said, this demand is translating into transactions. Although down around 1% on March 2023, partly due to some retailers being caught out with difficulties sourcing replacement stock for cars sold quicker than anticipated, Auto Trader’s retail sales data indicates a positive 2% YoY increase across the quarter.

The outlook for the used car market remains stable, but with such nuance in the market, it’s important to examine the data at a granular level to not only identify emerging profit opportunities, but also potential trends that may affect bottom lines. Indeed, whilst there are variances in supply and demand across different segments of the market, there are certain key cohorts where the dynamics are playing out more dramatically and will need to be monitored carefully.

For example, ‘nearly new’ cars (those aged below 12 months old) are currently recording exceptionally high levels of both consumer demand and supply, up 30.4% YoY and 42% respectively last month. However, with manufacturers applying heavy discounts to brand-new cars to stimulate retail demand, particularly for the growing array of electric models, nearly new models are set to face increasing competition this year. As a result, demand may well soften whilst supply levels continue to soar as manufacturers once again resort to short cycle sales channels to achieve volume targets.

Among older cohorts, stock aged 10-15-years-old may face a similar impact on market dynamics over the coming months. Whilst strong supply (up 12.1% YoY in March) is already outpacing a recent softening in consumer demand (down -3.3% YoY) on Auto Trader, the imbalance is only set to increase as the huge number of brand-new cars sold during the 2014 – 2016 boom flow through the used car market. So, whilst demand appears set to remain relatively stable for these more affordable cars, supply levels could soon begin to accelerate further.

Commenting, Richard Walker, Auto Trader’s data & insights director, said: “Despite an uncertain economic and political backdrop, we’ve seen a positive start to 2024, with demand remaining robust throughout the quarter. But whilst our outlook for the rest of the year is confident, retailers face an incredibly nuanced and complex market which will continue to move at pace.

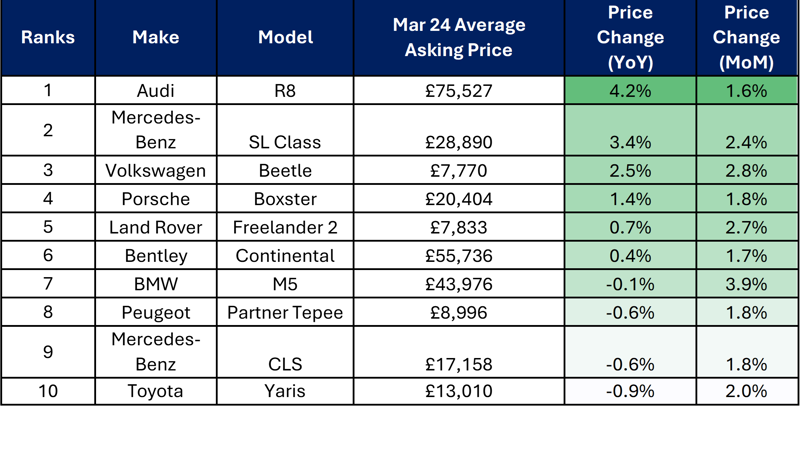

Top 10 used car price growth (all fuel types) | March 2024 vs March 2023 like-for-like

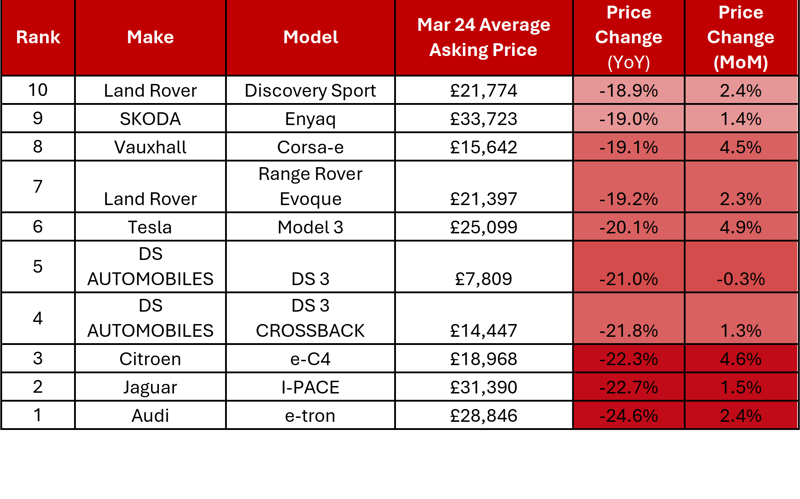

Top 10 used car price contraction (all fuel types) | March 2024 vs March 2023 like-for-like