The passenger vehicle market leader, which has seven hatchbacks in the fray, leads each of the three sub-segments with its Alto, Wagon R and Baleno.

India’s car market, once teeming with hatchbacks aplenty, now has only 17 vehicles left in the segment, and in FY2023, these models comprised three budget cars, eight entry and mid-level hatchbacks and six premium models.

Clearly, the surging demand for utility vehicles, which now account for 51.5 percent of the overall passenger vehicle (PV) market, is eating into the hatchback and sedan segments. Let’s take a closer look at how each of the three sub-segments fared in FY2023, as per data sourced from JATO Dynamics India.

Three’s company in budget hatches

Passenger vehicle market leader Maruti Suzuki, remains the boss of the hatchback segment despite its overall share reducing to 41.3 percent in FY2023. The carmaker has seven hatchbacks and leads each of the three sub-segments.

However, proof that demand for its two budget models is yet to perk up is the combined sales of the Alto and S Presso: 2,32,911 units, up 10 percent YoY (FY2022: 2,11,762). While demand for the Alto was down 24 percent to 1,79,698 units, that for the S Presso fell 20 percent to 55,213 units. While both cars are seeing an increase in customer interest – following the launch of the S Presso CNG and third-generation Alto K10 – Maruti Suzuki would prefer some acceleration in sales of these mass-market models.

Meanwhile, the two small Marutis’ rival, the Renault Kwid, has not fared better either. It sold 19,498 units, which is a decline of 26 percent over FY2022’s 26,535 units.

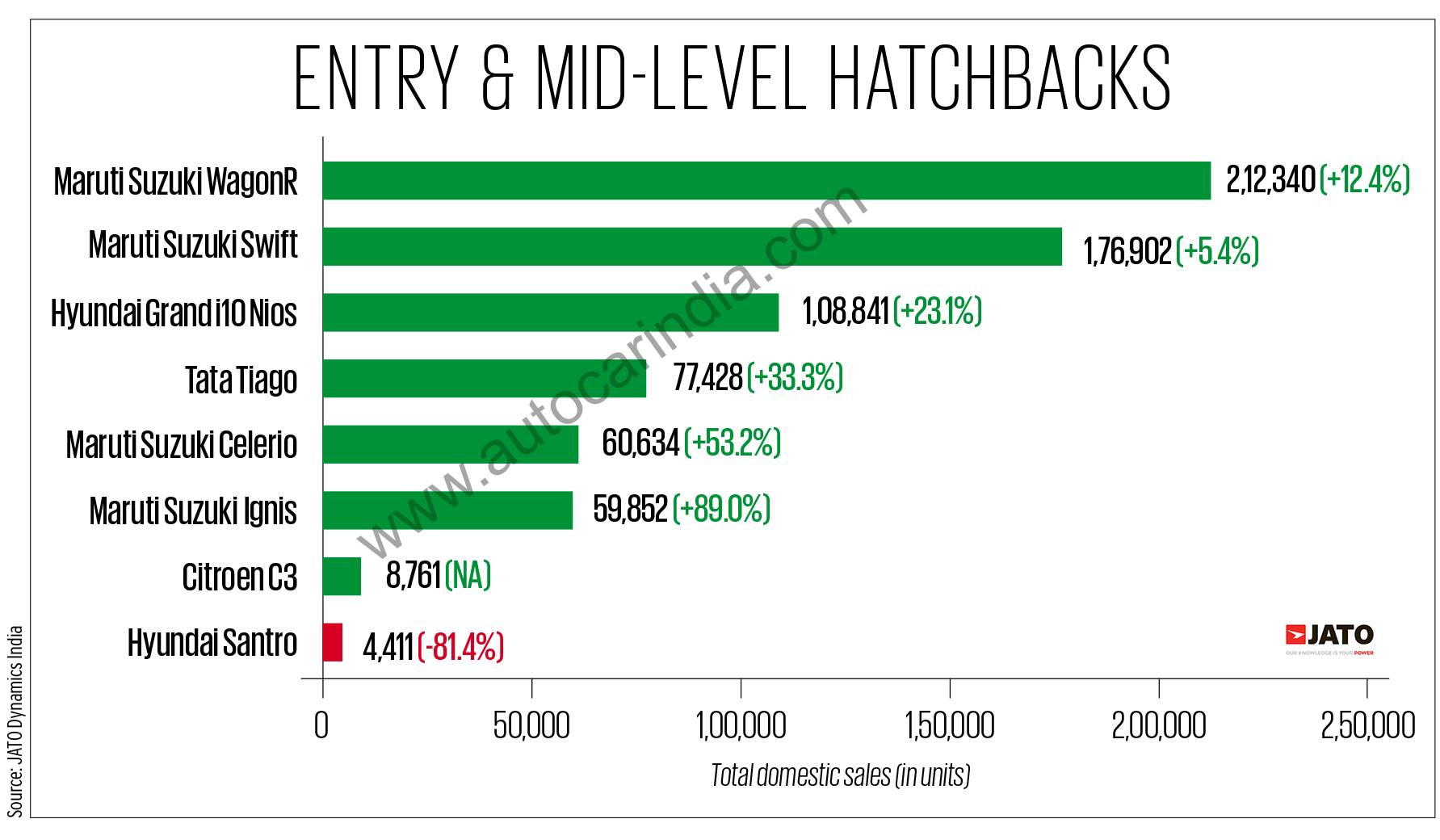

Wagon R tops them all with 2,12,340 units

In the midsize hatchback category, Maruti Suzuki India has a 72 percent share with four models – 5,09,728 units out of a total of 7,09,169 units. Of this, the bestseller remains the Wagon R with 2,12,340 units and 30 percent of total sales.

The Wagon R with 2,12,340 units and 12 percent growth retains its title as India’s bestselling passenger vehicle. This practical, easy-to-live-with hatchback for reasonable money now has the option of a peppier 1.2-litre engine. An AMT option on both engines (1.0-litre and 1.2-litre) adds to the convenience factor, while the CNG version continues to bring in additional customers.

The Swift, with 1,76,902 units and 25 percent segment share, is 35,438 units behind its sibling and takes second place in the mid-level hatch category, maintaining its FY2022 ranking. The snazzy Swift has done well to record 5.40 percent growth (FY2022: 1,67,827). The third-gen Swift has a chic design, neat cabin and a new 90hp frugal petrol engine, but the earlier model’s nippy dynamics are missing. The AMT gearboxes, however, offer convenience.

The Hyundai Grand i10 Nios sold 1,08,841 units and grew 23 percent over last year. Priced between Rs 5.69 lakh-8.47 lakh (ex-showroom), the Grand i10 Nios remains a compelling choice in the segment. It is a sensible and well-equipped family hatchback that is at home in urban environments.

Retaining its fourth position is the Tata Tiago with 77,428 units, having recorded a strong 33 percent growth over FY2022’s 58,091 units. Tata Motors’ smart and likeable city hatchback, which comes with competitive pricing and sharp design cues, aims to deliver a premium experience at an affordable price. The Tiago is offered in petrol and petrol-CNG versions, both powered by a 1.2-litre engine. The newest avatar is the Tiago EV, which has given a new charge to its sales. Tata Motors claims it has delivered over 10,000 Tiago EVs in the past four months.

Siblings to the Wagon R and Swift, the Celerio (60,634 units, up 53 percent) and Ignis (59,852, up 89 percent) also saw double-digit growth and were ranked fifth and sixth, respectively.

Taking penultimate position in the mid-level hatchback category is the new Citroen C3 with 8,761 units, split between the petrol-engined model and its electric variant. Citroen’s first mainstream model for the Indian market was launched in July 2022 at Rs 5,71,000 with two petrol engines on offer – a 1.2-litre naturally aspirated powerplant or a 1.2-litre turbo-petrol. The latter boasts of the highest torque stat of any small-capacity turbo-petrol motor in the Indian market. End-February 2023 saw the French carmaker launch the eC3 at Rs 11.50 lakh. What would have endeared the C3 to buyers is its quirky looks, spacious and comfy interiors and excellent ride quality.

Bringing up the rear in this category is the now-discontinued Hyundai Santro with 4,411 units.

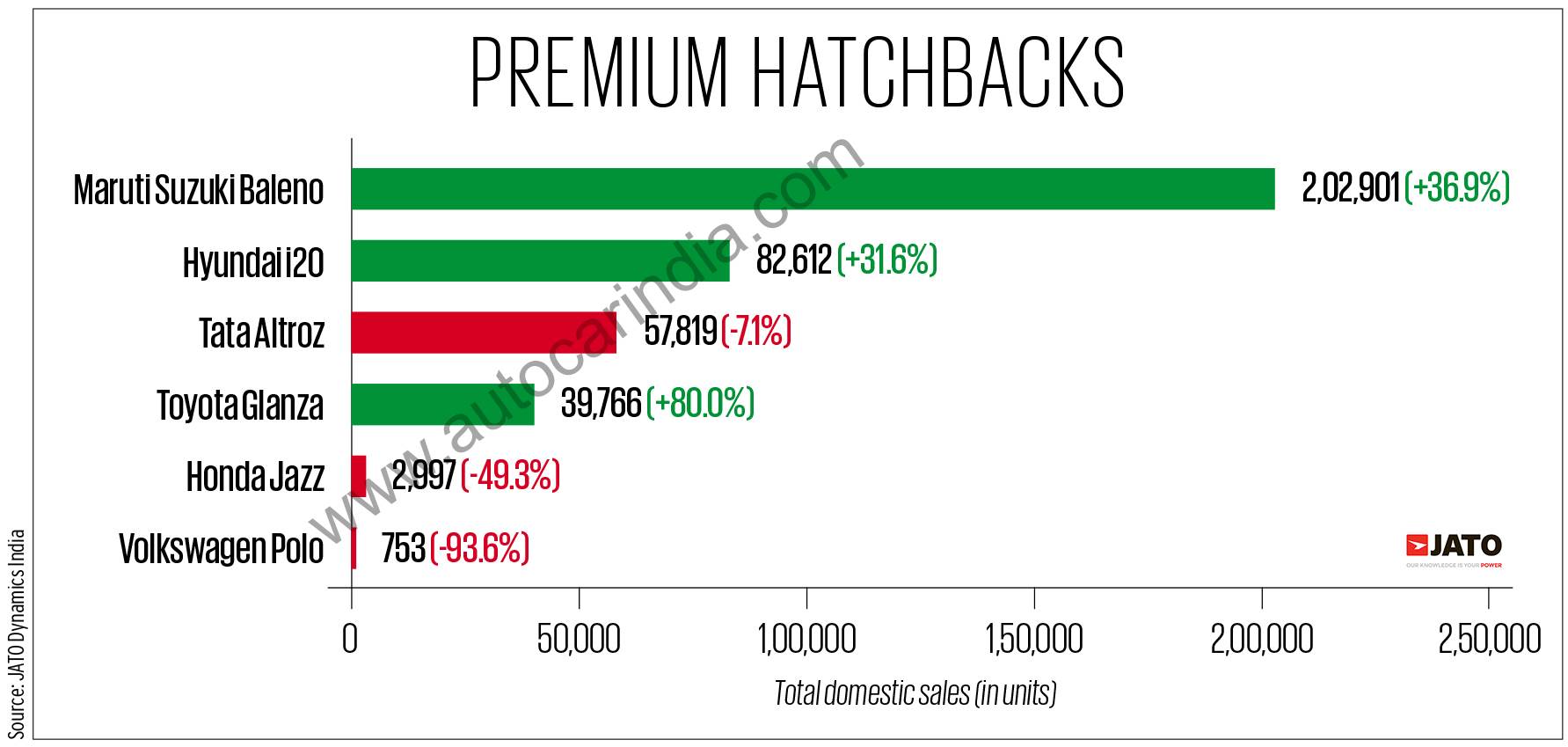

Maruti Baleno lords over premium hatch segment

What the Wagon R is to its segment, the Baleno is to the premium hatch category. With 2,02,901 units of the segment total of 3,87,386 units, the stylish Baleno commands a 52 percent share. Sales rose 37 percent over FY22, clearly indicating that this car remains a top draw among its target audience. India’s bestselling premium hatchback and the second bestselling car after the Wagon R, also crossed the 2,00,000 milestone for the first time.

FY2023 saw Maruti Suzuki expand its CNG portfolio to the premium Nexa category of cars and SUVs and the Baleno was the first Nexa model to get the S-CNG treatment, a move which has helped accelerate sales.

In second place is the Hyundai i20 with 82,612 units, with demand rising 31 percent (FY2022: 62,769 units). What helps keep the i20 fresh is the carmaker raising the bar for the segment with each new iteration as seen in the third-gen model. Available with three engine options – a 1.2-litre petrol, 1.0-litre turbo-petrol and a 1.5-litre diesel – the i20 gains from class leading features usually found in a segment above. However, that’s also reason why the new Hyundai i20 is the most expensive hatchback in its category.

The Toyota Glanza, which is a re-badged Maruti Baleno, with considerably changed visually in its second-generation avatar, sold a total of 39,766 units, up 80 percent over FY2022’s 22,097 units. Toyota rolled out the second-generation Glanza in March 2022, and compared to the original model – and to differentiate it from the Baleno – Toyota gave the new Glanza different frontal styling, including the headlights, grille and bumper, and alloy wheels.

In November 2022, Toyota entered the CNG market with the Glanza CNG. Clearly, the move has paid off because sales have risen smartly in FY2023. This also means that the Glanza accounted for 23 percent of its total PV sales of 1,74,015 units in FY2023, the company’s best-ever market performance in a decade.

Wrapping up the six-model table are the Honda Jazz with 2,997 units, down 49 percent (FY2022: 5,913 units) and the Volkswagen Polo with 753 units, down 94 percent (FY2022: 11,816 units).