The UK’s cost of living crisis and the impact of Russia’s war in Ukraine threaten the used car market’s shift towards stability, eBay Motors’ Dermot Kelleher has suggested.

The online marketing platform saw advertised prices dip 1.1% month-on-month to £17,636 during March as stock volumes rose 1% to 46.2 units and days to sell remained unchanged at 43.4 days in what its head of marketing and research Dermot Kelleher described as a welcome return of “a stable used car market”.

But Kelleher urged retailers to maintain their online visibility and keep a close eye on market trends as the rising cost of living and “international events” threatened to disrupt the sector.

“A stable used car market was a welcome trend for dealers in March, especially against a backdrop of a 14.3% drop in new car registrations during the all-important plate change month,” he said.

“The ongoing supply disruption caused by the global semiconductor shortage will continue to prompt in-market new car buyers to look at used alternatives.

“Although the dip in advertised prices was the biggest so far this year, prices remain incredibly strong, tracking at 19.5% ahead of where they were 12 months ago which should feed into some strong first quarter performances for many dealers.

“However, the challenge for the market over the coming weeks and months will be the impact of the cost of living squeeze and international events on consumer confidence.

“Our advice to retailers is to maintain the online visibility of their stock at all times and closely track pricing trends in their local areas and nationally.”

Last week Auto Trader director of data and insights Richard Walker has stated that suggestions of tumbling used car prices are “unfounded” – but conceded that demand is softening.

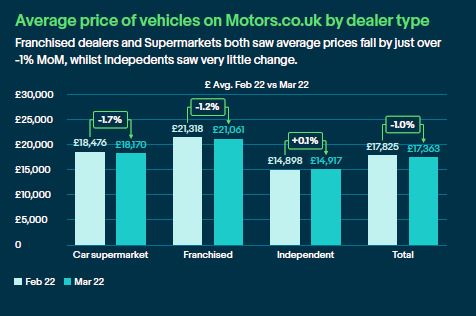

The eBay Motors market data for March showed that used car supermarkets made the biggest price cuts as consumer demand began to soften.

The eBay Motors market data for March showed that used car supermarkets made the biggest price cuts as consumer demand began to soften.

Supermarkets’ prices were down 1.7% (£306) as franchised dealers cut their prices by 1.2% (£257) and independents made a marginal 0.1% increase (£19).

Used car supermarkets also drove the growth in stock volumes with an average rise of 14 vehicles to 322, marking a recovery after February’s 13% drop.

Independents saw stocks increase by one unit to 35, while franchised dealers saw a drop of one unit to 57.

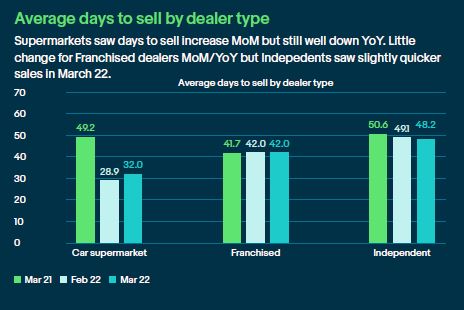

March’s days to sell KPI was just 0.2% lower than February at 43.4 days.

And despite increased stock and price drops it was used car supermarkets that held on to their stock longest, averaging 3.1 days longer in February (32 days).

Franchised dealers remained unchanged month-on-month at 42 days and independents saw a slight improvement from 49.1 to 48.2 days.

Franchised dealers remained unchanged month-on-month at 42 days and independents saw a slight improvement from 49.1 to 48.2 days.

According to eBay Motors, the fastest-selling used car in March was the Volkswagen Golf with diesel models aged six to eight years averaging just 19.7 days on forecourts.

Six to eight year old Ford Fiestas were second place in its best-seller rankings (20.9 days) with five to six year old Fiestas in third place (21.1 days).

The fastest selling fuel type was electric (39 days), followed by hybrid (40.5 days), diesel (42.7 days) and petrol 44.2 days.